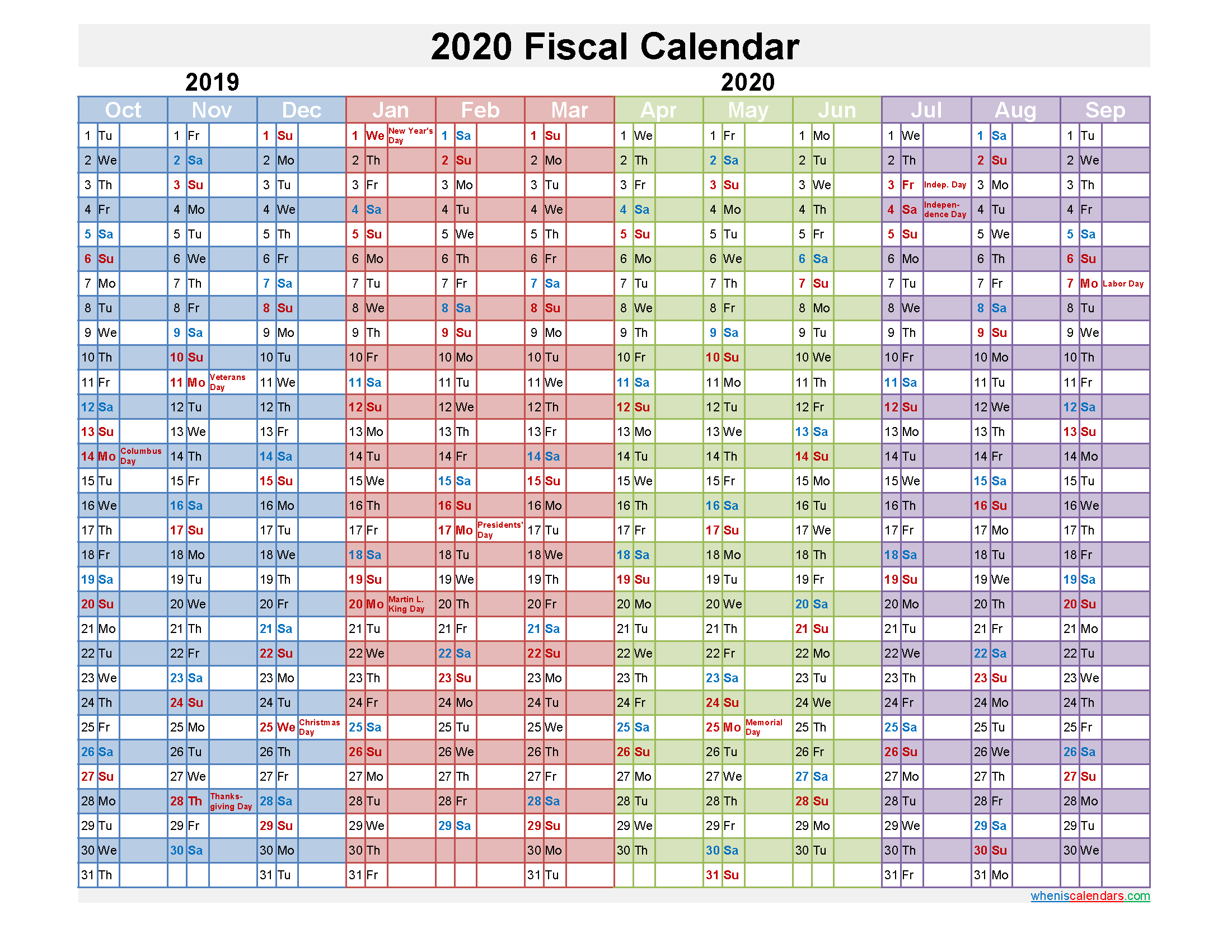

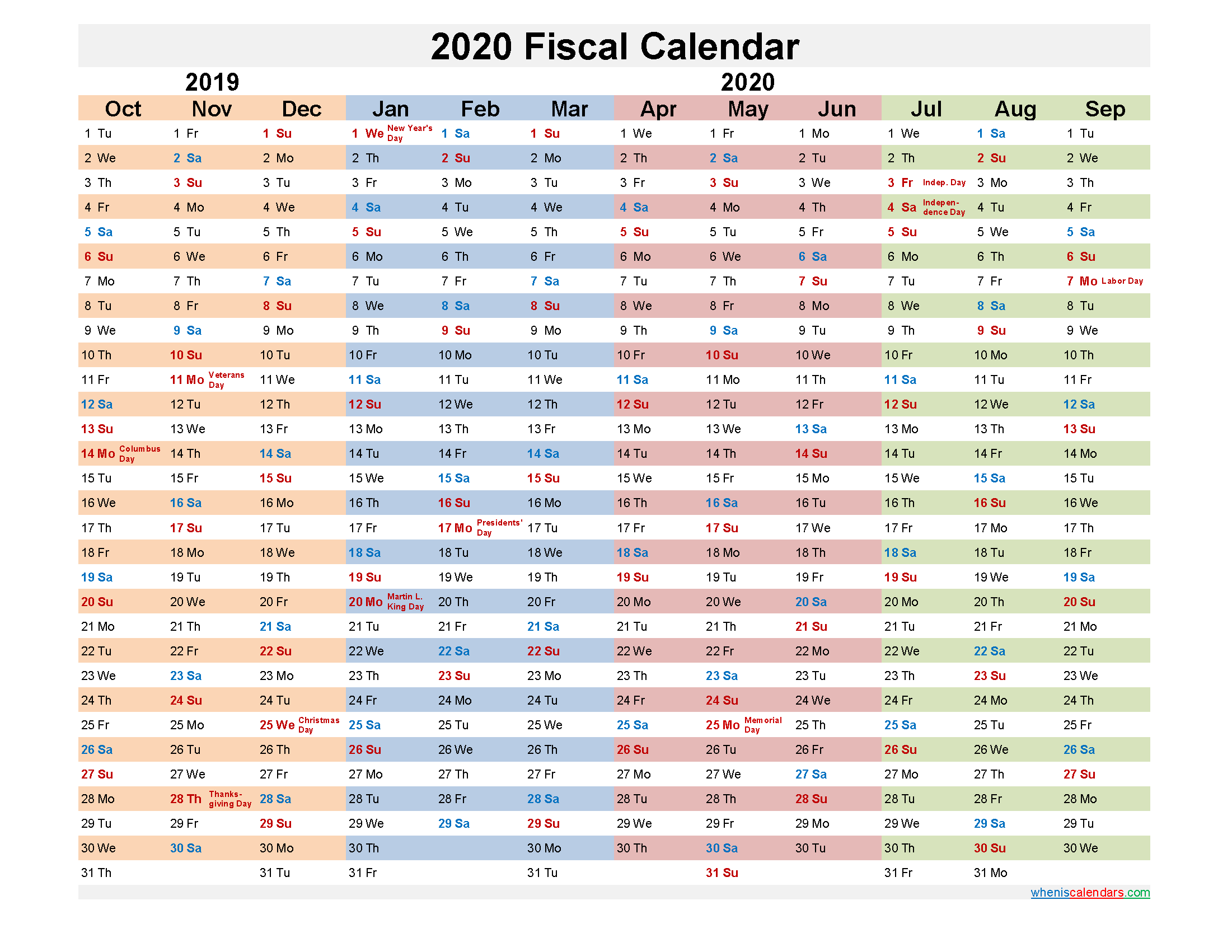

Calendar Year Vs Fiscal Year Definition 2024. If a company has a fiscal year-end that is the same as the calendar year-end, it means that the. The federal government uses a fiscal year for its budget. News Career development Fiscal Year vs. The fiscal year is more suitable for tax reporting if the business cycle. Does the IRS require a fiscal or calendar year? Although a fiscal year need not start at the beginning of the calendar year, it must be a yearlong period. A fiscal year is also known as a financial year. Key Takeaways A fiscal year is a twelve-month period chosen by a company to report its financial information.

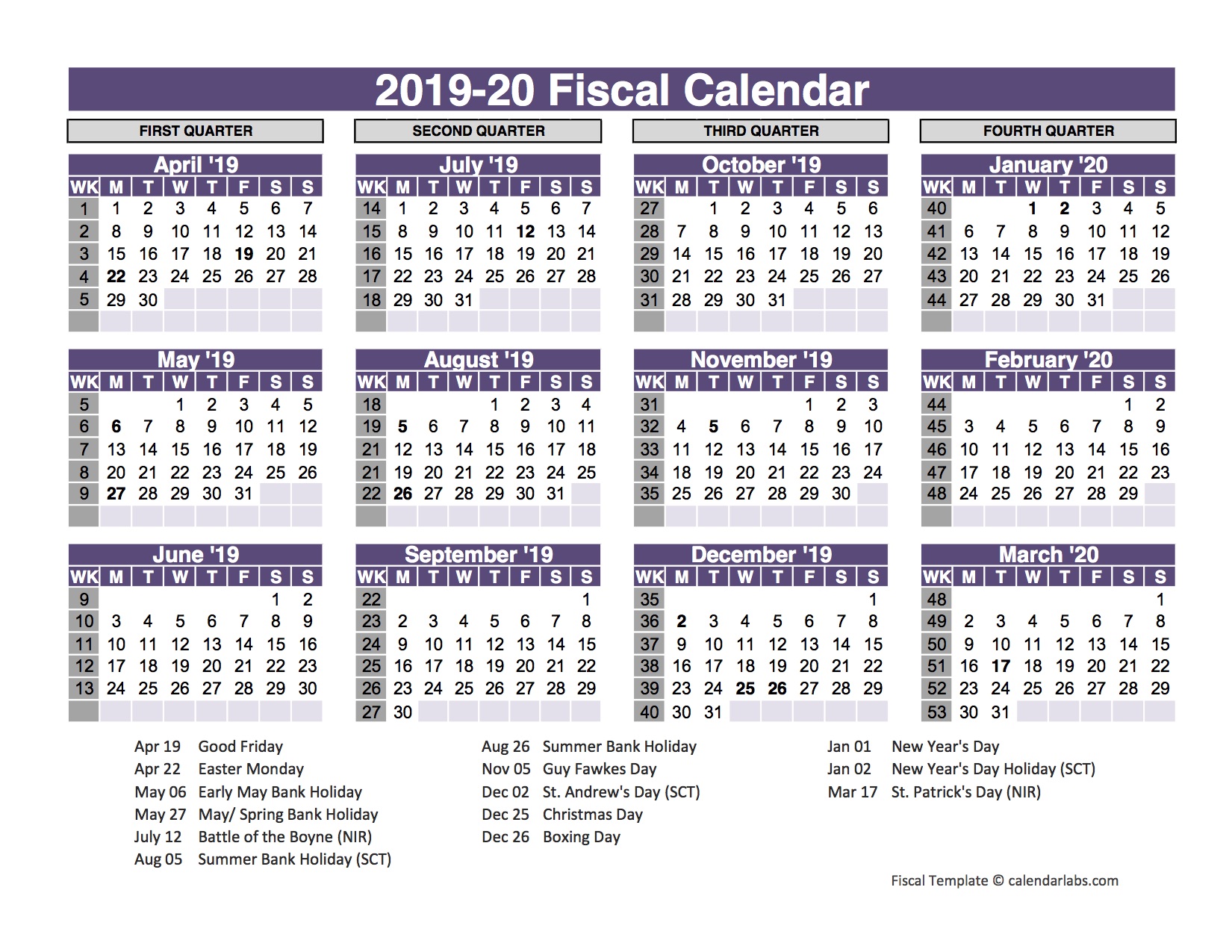

Calendar Year Vs Fiscal Year Definition 2024. While countries generally have a default fiscal year used by the government, they often allow individuals and organizations to employ different fiscal years based on their specific needs. Financial reports, external audits, and federal tax filings are based on a company's. A fiscal year is also known as a financial year. Key Takeaways A fiscal year is a twelve-month period chosen by a company to report its financial information. Each fiscal year is further broken down into segments called "fiscal periods." Continue to reading more about how these fiscal periods work at UCI. Calendar Year Vs Fiscal Year Definition 2024.

This typically uses over half of all funding.

Calendar Year: Definitions and Benefits Fiscal Year vs.

Calendar Year Vs Fiscal Year Definition 2024. Annual funding areas The annual budget covers three spending areas: Mandatory spending – funding for Social Security, Medicare, veterans benefits, and other spending required by law. If a company has a fiscal year-end that is the same as the calendar year-end, it means that the. A "tax year" is an annual accounting period for keeping records and reporting income and expenses. The fiscal year is more suitable for tax reporting if the business cycle. Understanding the ramifications of using a fiscal year or a.

Calendar Year Vs Fiscal Year Definition 2024.